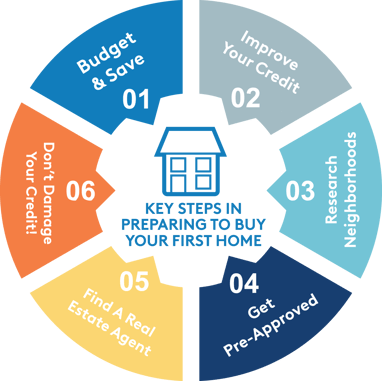

6 Key Steps in Preparing to Buy Your First Home

Are you ready to take the exciting step towards purchasing your first home? This article will guide you through the key steps you need to take to prepare for this big milestone.

Setting Your Budget and Saving for a Down Payment

Setting Your Budget and Saving for a Down Payment

Before you start searching for your dream home, it's important to set a budget and save for a down payment. Determine how much you can afford to spend on a house by considering your income, expenses, and financial goals. This will help you narrow your options and avoid falling in love with a home that's out of your price range. Additionally, saving for a down payment will give you a stronger position when applying for a mortgage, as it shows lenders that you have financial stability and are committed to the purchase.

Some mortgage plans ask for only a tiny down payment or sometimes nothing at all. It's worth having a chat with a mortgage lender to figure out how much you'll need to set aside for your own situation. - Teresa Jorgensen, AVP Mortgage Services

To save for a down payment, create a budget that allows you to set aside a portion of your income each month. Consider cutting back on unnecessary expenses and finding ways to increase your savings. You may also explore down payment assistance programs or government grants that can help you reach your savings goals faster. Remember, the larger your down payment, the lower your monthly mortgage payments will be.

Calculate your mortgage options here.

Improving Your Credit if Needed

Improving Your Credit if Needed

Your credit score plays a crucial role in the homebuying process. A higher credit score can help you secure a better mortgage rate, which can save you thousands of dollars over the life of your loan. If your credit score is less than ideal, take steps to improve it before applying for a mortgage.

Start by obtaining a copy of your credit report from the three major credit bureaus (Experian, TransUnion, and Equifax) and review it for any errors or discrepancies. Dispute any inaccuracies and work on paying off any outstanding debts. Make sure to pay all your bills on time and keep your credit utilization ratio low. Avoid opening new credit accounts or making large purchases that could negatively impact your credit score. With time and responsible financial habits, you can improve your credit and increase your chances of getting approved for a mortgage with favorable terms.

Researching Neighborhoods and Choosing the Right Location

Researching Neighborhoods and Choosing the Right Location

Choosing the right location is essential when buying a home. Research different neighborhoods to find the one that best fits your lifestyle, preferences, and needs. Consider factors such as proximity to work, schools, amenities, safety, and future development.

Take the time to visit potential neighborhoods and explore the area. Talk to locals, visit local businesses, and attend community events to get a feel for the area. You can also use online resources and tools to gather information about crime rates, school ratings, transportation options, and property values. By researching neighborhoods, you can make an informed decision and find a location you'll be happy to call home.

Getting Pre-Approved for a Mortgage

Getting Pre-Approved for a Mortgage

Before you start house hunting, get pre-approved for a mortgage. This involves meeting with a lender who will evaluate your financial situation and determine how much they are willing to lend you. Getting pre-approved gives you a clear idea of your budget and shows sellers that you are a serious buyer.

To get pre-approved, gather the necessary documents, such as pay stubs, bank statements, and tax returns. Provide the lender with accurate and up-to-date information about your income, assets, and debts. They will assess your financial profile, including your credit score, employment history, and debt-to-income ratio. Based on this information, they will issue a pre-approval letter stating the maximum loan amount you qualify for. Keep in mind that pre-approval is not a guarantee of a mortgage, but it strengthens your position as a buyer and makes the home-buying process smoother.

Always check to see if there are any government first-time home-buying programs available. These programs can assist you in purchasing your first home. Government first-time home-buying programs may provide financial support, lower interest rates, or help with down payments, making home homeownership more achievable for you. Research and understand the specific requirements and benefits to see if you qualify and how they can best support your home-buying journey.

Finding a Real Estate Agent to Assist You

Finding a Real Estate Agent to Assist You

Navigating the real estate market can be overwhelming, especially for first-time buyers. That's why working with a professional real estate agent who can guide you through the process and help you find your dream home.

Ask for recommendations from your mortgage lender for realtor recommendations or friends, family, and colleagues who have recently purchased a home. You may even want to research potential agents online and read reviews to get an idea of their expertise and track record. Schedule interviews with a few agents to discuss your needs and expectations. Look for an agent who is knowledgeable about the local market, responsive to your inquiries, and has good communication skills.

Once you find the right agent, they will assist you in finding suitable properties, scheduling viewings, negotiating offers, and handling the paperwork. Their expertise and experience will be invaluable in ensuring a smooth and successful homebuying experience.

Don't Damage Your Credit

Don't Damage Your Credit

As you navigate the home-buying process, it's crucial to stay on top of your financial game. Why? Because final approval for your loan doesn't happen until it undergoes underwriting, which could occur just before closing. To maintain a healthy credit score, steer clear of taking on new debt (like an auto loan), opening additional credit cards, neglecting student loan payments, or falling behind on credit card bills.

605-334-2471

605-334-2471